IDEX Online Research: US Sees Continuing Strong Demand for Jewelry

October 15, 13

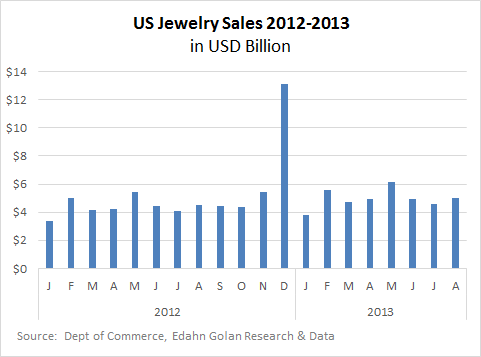

(IDEX Online News) – Jewelry and watch sales in the U.S. increased by 4.8 percent to $5.64 billion in August, based on Department of Commerce figures. Due to the shutdown of U.S. government services, information about sales by specialty jewelers during the month is not currently available.

The full analysis of the polished diamond prices is available to IDEX Online Research subscribers and IDEX Online members here.

Jewelry sales alone, excluding watches, totaled $5.0 billion in August, rising 4.7 percent year-over-year. After maintaining sales increases of at least 6.5 percent year-over-year since November 2012, monthly jewelry sales fell below that level for the first time in July, and we note that this declining trend continued in August.

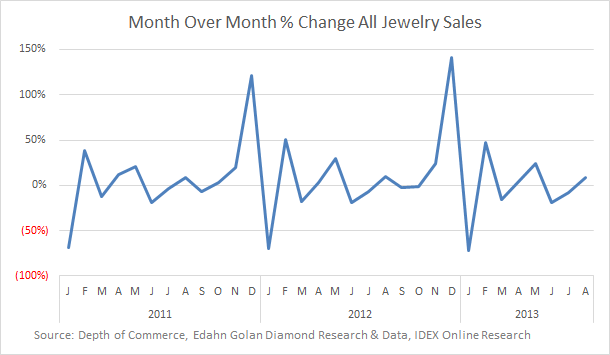

On a month-over-month basis, jewelry sales in August increased by a robust 8.3 percent, a cyclical trend. Historically, after decreasing in June and July, jewelry sales in the U.S. increase in August, as the following graph shows.

Watch sales in August increased by 5.5 percent on a year-over-year basis, totaling $662 million. Changes in watch sales trends are echoing those of jewelry sales. Here, too, the increase in watch sales softened in August for a second consecutive month compared to sales in 2012.

Month-over-month, watch sales increased by 7.9 percent in August. Once again, after the June-July decreases, sales increased in August as they typically do.

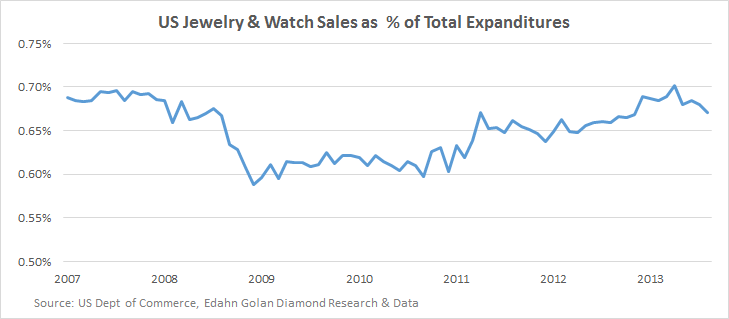

Spending on jewelry and watches is just shy of 0.7 percent of total U.S. consumer expenditure. This figure has been fairly consistent over the years, however due to the size of the U.S. market, tiny changes of a fraction of a percentage point represent large changes in how much of their budget Americans are willing to spend on jewelry in dollar terms.

After a decline in the aftermath of the 2008 crash, sales as a percentage of total expenditure have been growing since 2009, peaking at 0.70 percent in March 2013. Since then, spending on jewelry and watches is slowly weakening. In August 2013, it stood at 0.67 percent, based on seasonally adjusted annualized rates.

American consumers are voting with their wallets – and showing continued interest in jewelry in 2013. While we see a long-term growth trend, in the past few months this growth has been slowing. This is not a reason for concern, at least not yet. However, all sectors of the jewelry industry should pay attention to this change and ensure that they are ready for a shift in direction – if it indeed happens.

The full analysis of the polished diamond prices is available to IDEX Online Research subscribers and IDEX Online members here. Click here for more information on how to subscribe or become a member.