IDEX Online Research: Polished Diamond Prices Rise in June

July 05, 15

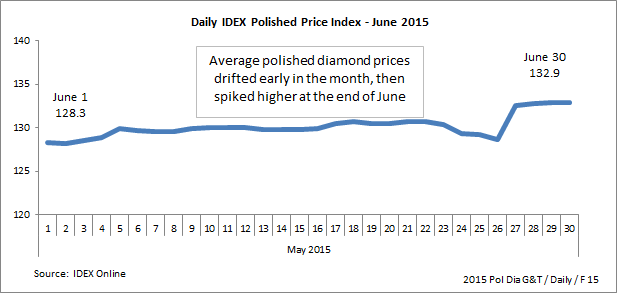

After languishing for most of the month, global polished diamond prices perked up notably in the final days of June. The rise in diamond prices is most likely related to the “jewelry show” effect. As traders gather and hold goods for the particular show, fewer items are available in the trading centers, causing prices to go up.

The IDEX Index of Global Polished Diamond Prices averaged 130.1 during June, up from May’s average of 128.7. The good news: prices remain well ahead of the year’s low of 123.7 in February.

Polished diamond prices reached a daily IDEX index high of 132.9 on the last day of June, and have held near that level for the first few days of July.

Polished diamond prices were flattish most of the month, then showed a spike on June 27. Since then, prices have been flat at the new higher level.

Polished Diamond Prices Show Movement

After significant volatility during the third and fourth quarters of 2014 and early 2015, global polished diamond prices continued rose in June after slipping in May from higher levels in March and April.

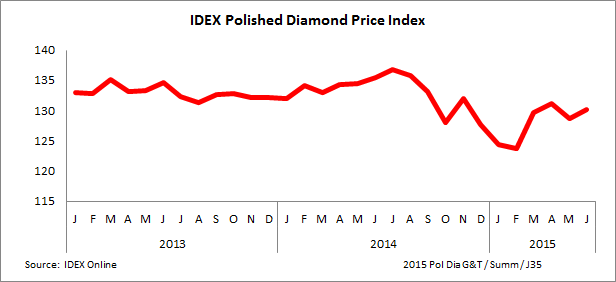

The graph below illustrates long term trends – and recent volatility – for polished diamond prices.

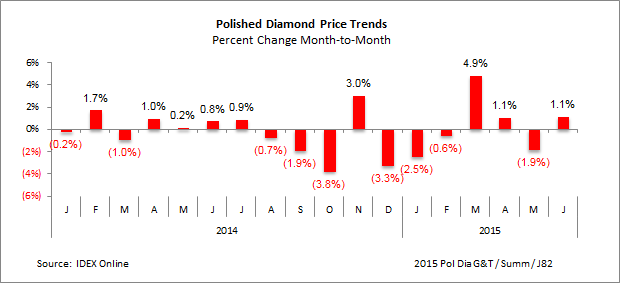

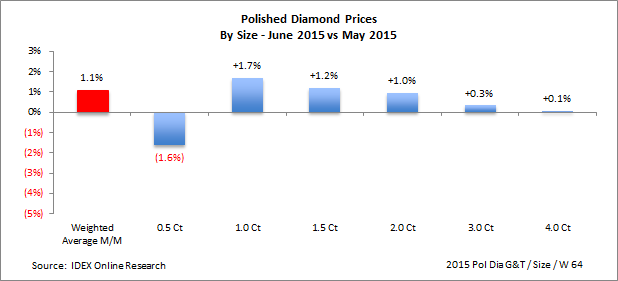

On a month-to-month basis, June global polished diamond prices were up by about 1 percent, when compared to May, as the graph below illustrates. Further, the graph illustrates the volatility of recent polished diamond prices.

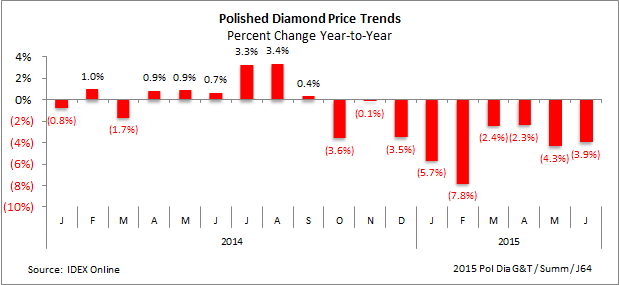

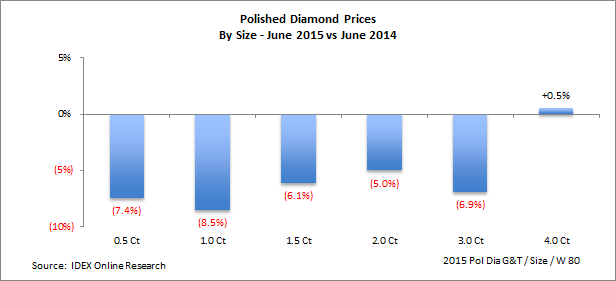

On a year-to-year basis, global polished diamond prices were lower in June, when compared to the same month a year ago – June 2014 – as the graph below illustrates. This is a worrisome trend, since this is the tenth consecutive month that polished diamond prices have been flattish or below the prior year’s level.

Daily Diamond Prices Showed Little Movement until End of the Month

Polished diamond prices showed a modest upward trend for most of June, eking out a very small increase almost every day. Near the end of the month, however, they perked up notably, and have remained higher since then.

We believe that most of the price gain at the end of the month is related to the major global jewelry shows in May and June. In preparation for these events, traders begin to gather and hold goods, leading to a shortage of items to trade, which causes prices to go up.

The graph below summarizes polished diamond prices on a daily basis during June 2015.

Most Key Size Diamonds Rose in Price During June vs May

Virtually all of the major diamond sizes – except for 0.5-carat gemstones – rose in price during June compared to prices in May. Small stones – about 0.5 carats in size – showed a notable price decline since there appears to be an ample supply of these diamonds.

On a month-to-month basis – comparing prices in June 2015 to May 2015 – prices for most polished diamonds moved higher, as the graph below illustrates.

On a year-to-year basis – comparing prices during June 2015 to June 2014 – polished diamond prices were lower, except for 4-carat stones. The graph below illustrates the year-to-year price trends for polished diamonds by size.

Outlook: Diamond Prices Likely To Stay in Narrow Trading Range

In the past, we’ve cited many reasons that diamond prices are not expected to rise significantly – or decline notably – this year. The global economy is sluggish, shoppers are showing restraint and diamond supply and demand is roughly in balance.

As a result, it is most likely that diamonds will trade in a relatively narrow range for the balance of 2015.