De Beers Town Hall Meeting: Creates Confidence, Hears Sightholders Oppose Price Hikes

June 04, 09

The first-ever diamond town hall meeting was received very positively by the market. Traders said the event, in which De Beers Managing Director Gareth Penny spoke but mostly answered questions from the audience, created a good sense of confidence; not only in the future of the industry but also in the role the leading rough diamond supplier is playing.

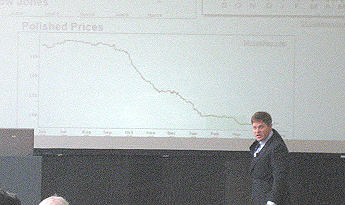

Recovery ahead: Penny, referring to the IDEX Online Price Index, said he sees reliable indications that the market is starting to stabilize |

Diamond Trading Company Managing Director Varda Shine opened the meeting, stating that the industry needs to consider different ways to operate in order to succeed.

Answering a question from moderator Chaim Even-Zohar, Penny was unwilling to disclose if the company will raise prices at its upcoming Sight.

“We expect rough [prices] to be more in line with polished,” Penny said. “We are looking at it, continue to monitor the situation.” Essentially this is an issue of stocks and liquidity, he added. Polished diamonds have maintained their prices in the past five weeks.

The discussion about rough prices, especially against the backdrop of rising demand for rough diamonds and greater financial liquidity, prompted a number of bold statements. Kaushik Mehta, chairman and CEO of DTC Sightholder Eurostar, warned that rising prices will be a “booms day in the rough market and a dooms day in the polished.”

During the discussion, Penny quoted a golf player who said “You drive for show, but putt for dough,” or in other words, while traders may make bold purchase to show off financial might, at the end of the day, all business decisions must have a sound economic footing.

Answering questions from the audience, Penny said the De Beers’ Element 6 subsidiary, which makes lab-made industrial grade diamonds, will not make gem quality goods. He noted that De Beers has been approached several times in the past six months about diamond backed funds, and wondered if it was appropriate for the company to get involved. He also said that the company has good relations with the banks and everyone can be confident about the continuation of De Beers.

In response to a question about finding a way for the industry to avoid price speculation, Penny said the only answer is to make sensible business decisions. He also defended moving sorting operations to

According to Penny, there are economic indicators that the worst is possibly behind us. With prices historically rising after periods of recession in the