LKI Shifting Some of its Activities to Israel

January 13, 10

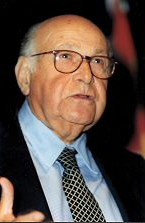

Tempelsman (above) plans to shift rough diamond activities to Israel |

The announcement follows a meeting between LKI Chairmen Maurice Tempelsman and IDE President Avi Paz. During the meeting, Tempelsman told Paz the company plans to bring very large quantities of rough diamonds to

Tempelsman added that some of its polished diamonds will also pass through the new Israeli office.

“The company’s activities in Israel will considerably raise Israel’s trade in rough and polished diamonds and make a significant contribution to the Israeli economy,” Paz said.

Formed in 1903, LKI is a public company listed on the New York Stock Exchange (NYSE) and the American Stock Exchange (AMEX). After a long period of disappointing results, the company received a Deficiency Letter from the NYSE AMEX in September 2009, following the company's failure to file its annual report for the fiscal year ended May 31, 2009.

On December 31, the last day to file the results, LKI submitted to the NYSE Regulation a supplement to its plan of compliance requesting an extension of the Exchange's delisting deadline to May 31, 2010. The company said this would give it the necessary time to prepare and file all delinquent reports. The request is currently under review.