IDEX Online Research: U.S. Jewelry Retail Prices Climb 2% in January

February 28, 13

(IDEX Online News) – Suppliers’ wholesale prices of jewelry were stable in January, but retail merchants scrambled to raise prices of their jewelry prior to the Valentine’s selling period.

The full analysis

Here are the key inflation trends for the

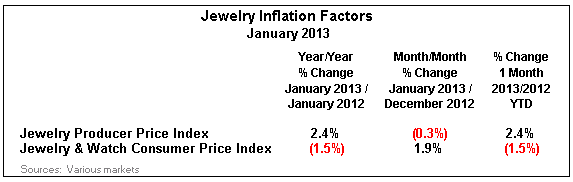

· Jewelry suppliers’ wholesale prices were marginally down by 0.3 percent, when comparing January 2013 prices to December 2012 prices.

· Jewelry suppliers’ wholesale prices were up by 2.4 percent, when comparing January 2013 prices to the same month a year ago.

· Jewelry retail prices rose sharply by nearly 2 percent, when comparing January 2013 prices to December 2012 prices.

· Jewelry retail prices were down 1.5 percent, when comparing January 2013 prices to January 2012. This means that retail jewelry prices in the

Long Term: Retail Margin Squeeze Remains

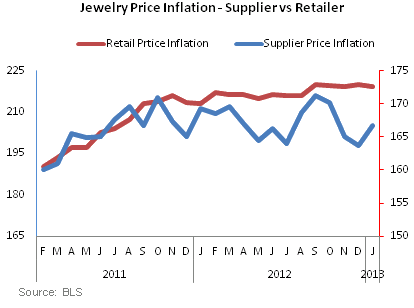

Jewelry suppliers’ prices correlate closely with prices of underlying jewelry commodities including precious metals and polished diamonds. Those prices have been relatively steady for many months. Further, a strong U.S. dollar has helped offset jewelry suppliers’ labor cost increases. As a result, jewelry suppliers’ prices have edged higher at roughly their historic rate of 2-3 percent annually.

Jewelry retail prices have been both volatile and erratic. Retail merchants of jewelry tried to raise prices to boost margins, but have been forced to roll back those price hikes due to weaker-than-expected demand.

When jewelry suppliers’ prices are compared to retail jewelry prices, it is clear that retailers’ long-term margin squeeze increased in 2012: supplier prices are up by 2.4 percent and jewelry retail prices are down by 1.5 percent, on a year-over-year basis.

The graph below summarizes twenty-four months of inflation and deflation for the

Detailed Inflation and Deflation Data

The full analysis and statistics on jewelry industry inflation for January 2013 is available to IDEX Online Research subscribers and IDEX Online members here (supplier) and here (retail). Click here for more information on how to subscribe or become a member.