IDEX Online Research: US Jewelry Sales Positive in October; September Data Revised Significantly Downward

December 13, 15

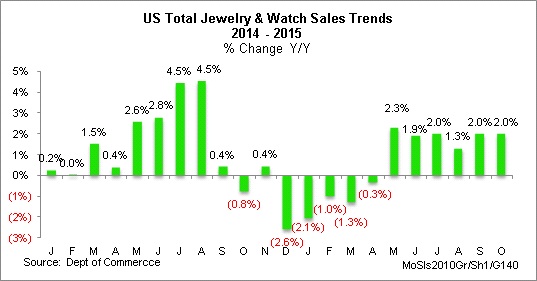

Total sales of fine jewelry and fine watches in the US market rose in October by 2.0 percent when compared to October a year ago. That gain is in line with the average of the past six months, a healthy sign. The big news, though, was the dramatic revision in September’s sales gain. Last month, the government’s preliminary report showed that sales surged by 4.8 percent in September; that was revised to a more realistic 2.0 percent.

Based on October’s continued trend of a low single-digit sales gain – in line with the average of the past six months – we are comfortable with our forecast of a sales gain in the low single-digit range for the all-important 2015 November-December period.

A Divided Market

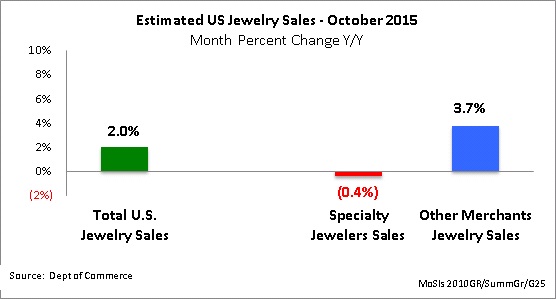

Total sales of fine jewelry and fine watches in the US market in October were an estimated $5.2 billion, according to the latest preliminary data from the Department of Commerce. The market remains bifurcated, as the following data illustrates:

• Specialty jewelers, those merchants who derive a majority of their revenues from the sale of jewelry and watches, posted a slight sales decline of 0.4 percent in October. Specialty jewelers’ sales represent just over 40 percent of total US jewelry sales. This group of retailers has been losing market share for the past four decades.

• Jewelry sales through multi-line merchants such as Wal-Mart, Costco, and others rose by an estimated 3.7 percent during the period. Jewelry sales through multi-line merchants represent just under 60 percent of total US jewelry sales.

• As we have often said, consumers are clearly shopping for “value,” and specialty jewelers have not been able to convey a “value” message.

Jewelry Demand Positive in October

Based on jewelry demand for the past six months, jewelry sales have grown by an average of just over 1.9 percent, excluding weak sales earlier in the year. On a full year-to-date basis, jewelry sales are up by only 0.7 percent for the first ten months of 2015.

The graph below illustrates monthly growth since the beginning of 2014, on a year-to-year basis, of fine jewelry and fine watch sales in the US.

It is important to note that the government made significant revisions to preliminary September sales data reported last month. Initially, the government’s data showed that total US sales of fine jewelry and watches were up 4.8 percent. After the first revision, the data shows that September jewelry sales grew by a more modest 2.0 percent. The September data could be revised several more times.

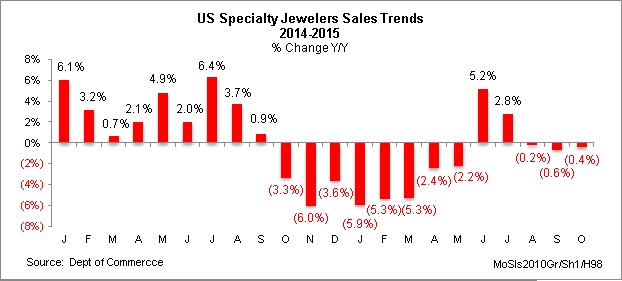

Specialty Jewelers’ Sales Weak

Specialty jewelers’ sales during October were an estimated $2.1 billion, a 0.4 percent decrease over October 2014, as the graph below illustrates. This is in line with reports from our sample of specialty jewelers. Most specialty jewelers report that customer traffic has been weak for the past several months, though the average ticket increased due to slowing sales of beads and improved sales of diamond jewelry.

Outlook – We Are Optimistic

The US jewelry industry is in the midst of the all-important November-December period. Based on some early reports, we believe that current sales trends will continue: low single-digit gains. Early reports also show that shoppers are buying their jewelry from multi-line merchants rather than at specialty independent jewelers.