Sarine Revenue hit by Weak Demand and Lab Growns

August 14, 25

(IDEX Online) - Sarine reported a 30 per cent fall in revenue and a marginal loss for the first half of 2025, amid ongoing weak demand for natural diamonds in the US and China, and the rising popularity of lab growns.

Revenue for H1 2025 was $15.3m, down 30 per cent year-on-year, but only 11 per cent below H2 2024, indicating some operational stabilization.

The Israel-based tech company made a loss of $166,000 for the six-months to 30 June, compared with a profit of $1m for the same period last year.

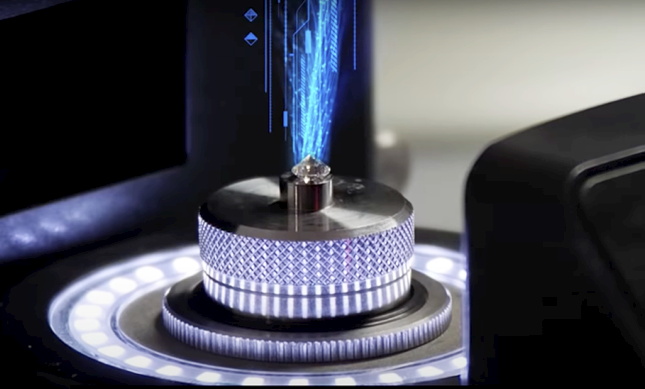

Sarine said the shift towards recurring revenues - Galaxy scanning, Gal3D, Advisor services, together with grading and traceability reports, now represents the vast majority of its income.

During H1 it also expanded the Most Valuable Plan, a new recurrent revenue service, to cover larger stone sizes.

And it has relocated manufacturing facilities to a wholly-owned subsidiary in India, to reduce costs.

Sarine is also in talks to acquire a 33 per cent stake in Kitov.ai, an AI-based visual inspection platform provider for aerospace, electronics and other industries beyond diamonds, in a move designed to broaden its revenue base.

Sarine said it expects demand for natural diamonds to remain at around the current levels for the rest of the year, although it cautioned that US tariffs, currently set at 50 per cent on Indian exports, could have a negative impact.

"The uncertainty surrounding the tariffs has resulted in delayed ordering by major US retailers ahead of the all-important end-of-year holiday season," it said.

"This prevailing new norm may change if U.S. diamond jewellers find the lower priced LGD unprofitable to offer, or if there is a pickup in demand from China. The constant erosion in the retail prices of LGD is becoming a challenge for diamond retailers."