Crooks Inc.

March 04, 10

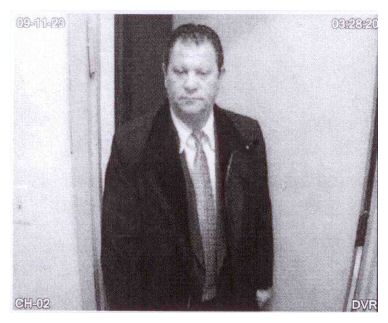

Please take a look at the below picture. If this man, using the false identity of Roman Rozzen from Rikko Company, has been in your office recently, please stop reading right now and go count your diamonds – each and every diamond in your stock.

It’s an old game. Crooks masquerading as legitimate diamond buyers manage to get into your office ostensibly looking to make a purchase. Then, they somehow succeed in pocketing a few stones before politely leaving your office without buying anything. This is something that Roman Rozzen allegedly did to at least one company (and probably more) in New York during the last few weeks.

The Diamond Importers and Manufacturers Association of America (DIMA) recently sent its members a quiet warning about this questionable man, which led to several responses by members who reported being visited by this crook. One was able to provide a picture from his security camera. Thanks to this picture, the crook has now been arrested by the New York City police. However, as of yet, the Assistant District Attorney in charge of the case declines to give information about whether the stolen diamonds have actually been recovered. What is known at this time is that his real name is Tamaz Hubel and that he is a Georgian, apparently now living in Florida.

The Diamond Importers and Manufacturers Association of America (DIMA) recently sent its members a quiet warning about this questionable man, which led to several responses by members who reported being visited by this crook. One was able to provide a picture from his security camera. Thanks to this picture, the crook has now been arrested by the New York City police. However, as of yet, the Assistant District Attorney in charge of the case declines to give information about whether the stolen diamonds have actually been recovered. What is known at this time is that his real name is Tamaz Hubel and that he is a Georgian, apparently now living in Florida.

The NYPD’s daily blotter claims that the 59-year-old thug stole two stones worth $50,000. We were also informed that one diamantaire is missing three stones; he may just be an additional victim.

Theft is foremost a matter of tremendous headaches. The Assistant District Attorney says that in many instances victims are not sure whether a theft has actually taken place or whether a diamond was just misplaced or otherwise lost. Moreover, when someone is arrested in possession of stolen diamonds, the victims can’t always prove that the arrested suspect is indeed the one who stole the diamonds or that the diamonds are theirs.

If Hubel has been arrested, why bother writing about it? We have learned that the police do not believe that this man had been acting alone. That is enough reason to make sure that everyone is warned.

Identification Verification and Due Diligence

There are two issues here. The first issue is the apparent ease with which someone off the street can manage to get into a diamantaire’s office and steal parcels of diamonds. The second issue deals with the identification and due diligence procedures in place.

The way this particular thief worked was to call the diamantaire’s office in advance, claiming that he is a customer of such-and-such company – normally a very reputable company in New York – and that he is looking for a particular item. He would then say that Mr. So-and-So of the reputable company had recommended that he specifically go to the victim’s premises. Purely based on that phone call, the victimized company would allow Hubel to enter and inspect goods without adequate supervision.

What is remarkable is that the victimized companies involved, as far as we know, have excellent security in place. In fact, Hubel is now sitting behind bars because a security camera actually did catch him putting stones in his pocket. Unfortunately, the theft was not realized in real time – it was only discovered a day later, after Hubel had long since left the diamantaire’s office. The swift action of the DMIA in alerting its members, and possibly risking some unpleasant legal consequences if the information turned out to be incorrect, needs to be applauded. It expedited the arrest and may have avoided many more losses.

We have not found any records of the existence of any Rikko Company or whether there is a real Roman Rozzen – a nice name for someone from Russian descent. This fraudster simply used another name and we don’t know if he was carrying false or stolen identity papers. Apparently, no great level of sophisticated paperwork was needed to get into the unsuspecting diamantaires’ diamond offices.

Identity Theft as Plague

There is an Israeli diamantaire who owns retail stores in the Far East; his name is his brand. In China, some unscrupulous crooks opened stores under the very same name. This blatant theft of name is currently pending in the courts and it may take years to resolve. But this case is unusual.

Identity theft is a far greater problem. In the United States, the second-largest group of filings of Suspicious Activities Reports has to do with identity theft. According to research data, there were 10 million victims of identity theft in 2008 in the U.S. alone. Actually, one out of every 10 U.S. consumers has already been victimized. Some 1.6 million households have seen their bank accounts, credit or debit cards being compromised. Half of the victims discover within three months that someone else is using their name or identity. In 20 percent of the cases, the victims don’t’ learn that their identity has been stolen for four or more years – and the damage can be awesome.

But the scariest part of this whole identity-theft problem, according to a 2004 study, is that “it can take up to 5,840 hours (which is the equivalent of working a full-time job for two years) to correct the damage from identity theft depending on the severity of the case. The average victim spends 330 hours repairing the damage.”

AML/CFT Compliance Requirements

The diamond industry in the U.S., Belgium, Israel and elsewhere is required by law, in a number of specific circumstances, to conduct thorough customer due diligence. The due diligence procedures include physical checking of identity cards and other relevant documentation. Therefore, if someone walks into a diamantaire’s office and claims he represents the Rikko Company, before a cash transaction can be completed or a customer relationship be established, the seller would have to obtain data on the beneficiary ownership of that company and ascertain, somehow, that the money received is “clean.”

Without commenting any further on the specific circumstances of the Hubel alleged theft(s), it is worthwhile to realize that identification and due diligence requirements are not being done to be compliant with laws but rather to protect ourselves. We sell an expensive, easily removable – and hard to recover – product. The police believe Hubel did not act alone. This may just be the right time to review one’s “entry procedures.” Better be safe than sorry.