IDEX Online Research: Jewelry Price Inflation Drops in December

February 10, 13

(IDEX Online News) – Retail prices of jewelry peaked at the end of the third quarter of 2012, and have been dropping steadily since, hitting their lowest level of the year in December.

Wholesale prices of jewelry have also flattened: they have remained stable throughout the fourth calendar quarter of 2012.

As demand for jewelry has softened, inflation at both the wholesale and retail level has evaporated.

Faced with slowing sales, retail specialty jewelers in the

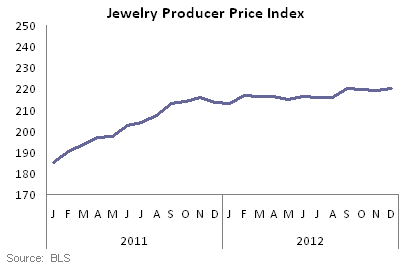

WHOLESALE: Jewelry Prices Essentially Flat in December

In December, the Jewelry Producer Price Index (JPPI) stood at 220.0, up slightly from November’s 219.4. A year ago, the JPPI stood at 213.6. Here is what this data means:

· Wholesale jewelry prices barely rose on a month-to-month comparison basis: December versus November 2012. As the graph below illustrates, jewelry price inflation at the supplier level has been relatively stable. While wholesale prices rose in September, they have held flat since then.

· Wholesale jewelry prices rose by about 0.3 percent on a year-to-year comparison basis: December 2012 versus December 2011. This inflation rate is down substantially from the double-digit inflation rates in 2011 and the first quarter of 2012.

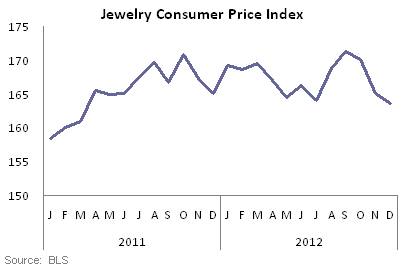

RETAIL: Jewelry & Watch Prices Fall Again in December

In December, the Jewelry & Watch Consumer Price Index (JCPI) stood at 163.6 versus November’s 165.1. A year ago, the JCPI stood at 165.0. For the first eight months of the year, the retail jewelry and watch price index was relatively stable in the 167-168 range, though it had shown some volatility, dipping to 164 in May and July. In September, the JCPI posted a sharp increase, only to fall back notably in October, November and December, when it hit its annual low.

· Retail prices of fine jewelry and watches fell by 0.9 percent on a month-to-month comparison basis: December versus November 2012. This implies an annual deflation rate of about 11 percent, an unrealistic level.

· Retail jewelry and watch prices in December were 0.9 percent below prices in December 2011. Retail prices of jewelry and watches had shown no significant inflation since mid-2011. However, in August and September, retail jewelers tried to push prices higher in anticipation of the holiday selling season. Based on the latest government data, jewelers have rolled back their prices since their peak in September.

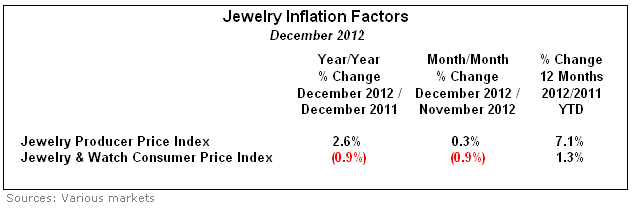

The table below provides inflation / deflation rates for jewelry.

Jewelry Inflation Outlook Unchanged: Moderate Inflation in 2013

Our outlook for jewelry price inflation remains unchanged: jewelry prices are expected to move modestly higher at all levels of the distribution channel in 2013. However, the rate of inflation is expected to be in line – or perhaps below – the moderating pace posted in 2012.