Polished Diamond Prices – An Overview

March 14, 13

By Edahn Golan

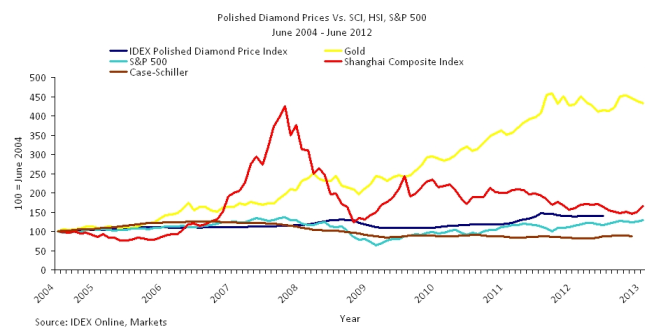

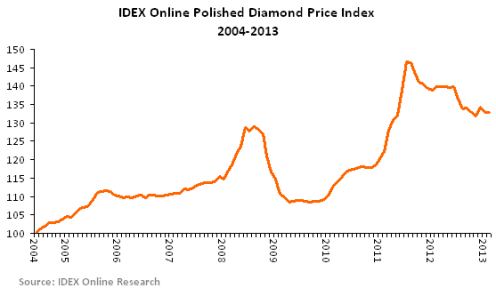

A look at the IDEX Online Polished Diamond Index since 2004 is possibly misleading. Graph 1 displays great rises and falls over the years and it appears that the price increases and decreases were large and swung widely. Despite their appearance, these changes are far more moderate than those exhibited by stock exchange indices, precious metal prices or other economic indicators.

|

The S&P 500, Shanghai Composite Index, Hang Seng Index, gold and oil all reflect different financial markets as and in the short-term, they all respond to different market forces. What unifies them is that they have all experienced broad changes over the past decade. In comparison (Graph 2), diamond prices did not swing as much, and seem almost dormant next to the great price flexibility of company shares and commodities.

|

|

The long-term trend, from mid-2004 to January 2013, shows that despite the apparent large peaks in price and the seemingly deep declines, the range of price changes is actually fairly narrow. Overall, prices have increased by some 33 percent in the eight and half year period since the IDEX Online Polished price Index was introduced in mid-2004, a moderate 4-percent compounded annual appreciation.

During the year, price changes are also fairly moderate. Peak to valley, prices typically fluctuate by about 5 to 7 percent during the year. The two exceptions to this were 2008 and 2011. Prices in August 2008 were on average down by more than 12 percent compared to January of that year, as the financial markets collapsed.

While a 12-percent decline is a large one, compared to the turmoil in other economic sectors and the deep falls in a wide variety of economic indicators – the stock markets and housing to name a few – polished diamond prices fared the crisis well, and declined much more softly.

During 2011, the situation was very different. Here, prices jolted upwardly in response to surging demand and greater financing availability before softening when buyers refused to continue accept the price hikes. The resulting fluctuation range was a record 21.9 percent, an upward leap that had not taken place since the 1980s.

The regular small changes are a reflection of polished diamond prices being constantly fine-tuned and adjusted by manufacturers and wholesalers according to their needs, limitations and the feedback they receive from their sales teams and buyers...

Clich here to see the full "Diamond Prices and the Forces that Shape Them" Focus.