IDEX Online Research: Retail and Supplier Jewelry Prices Fell in October

November 27, 13

(IDEX Online News) – Jewelry prices in the U.S. market dropped notably in October at the supplier level, and were down very modestly at jewelry retailers.

Jewelry suppliers’ prices declined from last year’s levels due to lower prices of precious metals including gold, silver, and platinum. However, a modest increase in polished diamond prices offset some of the decline in precious metal prices. Jewelry suppliers tend to price their goods based on the cost of raw materials.

With those costs declining – for example, gold prices are down by almost 25 percent from October 2012 and silver prices have fallen by 34 percent – it is no surprise that wholesale jewelry costs are lower this year than last year.

Because the overall global economy is still in a slow-growth mode, jewelry price inflation is expected to remain moderate for the foreseeable future.

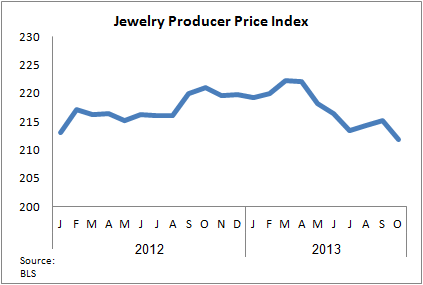

JPPI Shows Deflation in October

For October 2013, the Jewelry Producer Price Index (JPPI) stood at 211.8.

The graph below summarizes monthly JPPI over the past two years.

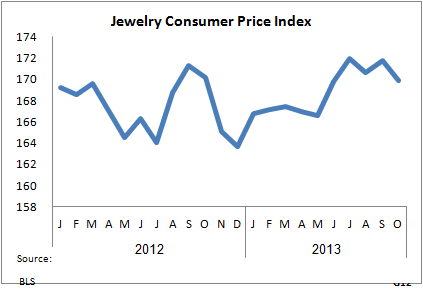

JCPI Declines Slightly in October

For October 2013, the Jewelry Consumer Price Index JCPI stood at 169.9.

Inflation Likely To Remain Moderate

While prices of precious metals – gold, silver, platinum – seem more or less stable currently, they correlate somewhat to the global economic climate. According to the latest forecasts from the OECD, global economic growth remains under pressure, with some significant differences by geopolitical region across the globe. As a result, jewelry price inflation is likely to remain relatively modest for the foreseeable future.