IDEX Online Research: US Retailers Raised Prices Just 0.5% in 2013

January 21, 14

(IDEX Online News) – December saw a further fall in U.S. retail jewelry prices following declines in October, September and November, while inflation at the supplier level showed a very slight decline. For all of 2013, the average increase in retail jewelry prices was just 0.5 percent.

The full analysis of the polished diamond prices is available to IDEX Online Research subscribers and IDEX Online members here.

JCPI Declines Slightly in December

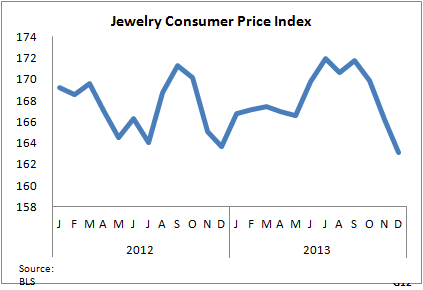

For December 2013, the Jewelry Consumer Price Index (JCPI) stood at 163.1 compared with 166.2 in November. Here’s what this means:

- Retail prices of jewelry dropped by 0.3 percent on a month-to-month basis: December 2013 versus November 2013.

- Retail jewelry prices decreased by 0.5 percent on a year-to-year basis: December 2013 versus December 2012.

The graph below shows the movements in the JCPI over the past two years, and in 2013 in particular it is clear that although there were rises in the late Spring through to the Summer months, retailers did not have the power over consumers to push through higher prices.

Indeed, the JCPI ended the year down on the start of 2013, at 163.1 compared with 166.7 in January.

The decline over the past four months, and certainly for December, provides strong evidence that retailers were busy attempting to attract buyers by cutting prices and offering widespread discounts. Retail sales following the Christmas holiday sales season and reports from Main Street showed that this was indeed the case. Retailers appeared to be almost desperate to shift stock out of their stores as the new year and new styles approached.

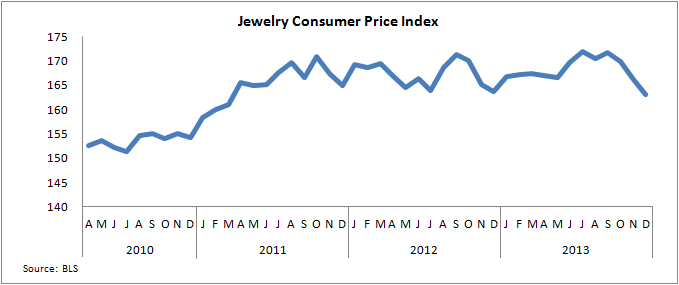

The graph below gives an historical perspective relating to movements in the JCPI over the past three and a half years.

JPPI Stands Still in December

For December 2013, the Jewelry Producer Price Index (JPPI) came in at 211.5 compared with 211.9 for the month before – in other words, it was almost unchanged. Here’s what this means:

Wholesale jewelry prices largely stood still on a month-to-month basis: December 2013 versus November 2013.

Wholesale jewelry prices fell by a sharp 3.8 percent on a year-to-year comparison basis: December 2013 versus December 2012.

The graph below summarizes monthly JPPI over the past two years.

The main impetus for the fall in producer price inflation in 2013 was the decline in jewelry suppliers’ prices from 2012, as precious metals including gold, silver, and platinum, dropped while polished diamonds largely stood still, though there were rises in certain goods, particularly smaller items.

Inflation Likely To Remain Moderate

With the start of the New Year and with new collections in the stores as well as Valentine’s Day coming up, it can be expected that retailers will attempt to push up prices. Clearly the battle between consumers and retailers will continue, but if the trend of 2013 continues, store owners and chains will find that power still resides with shoppers.

Economic growth in the United States, despite a record year for leading stock exchanges and continuing rises in housing prices, remains constrained by high unemployment. Although the official jobless rate is 6.7 percent, many analysts and financial observers believe the true rate could be twice that figure when unemployed who no longer receive state of federal assistance and others who have given up looking for work are counted.

Without spreading wealth across large sections of the U.S. population, a large rise in jewelry sales cannot be expected. And even among those in work, the latest official figures show that the average hourly wage of U.S. employees rose just 0.2 percent in 2013. The U.S. is forecast to add at least two million jobs for the fourth straight year, pumping more money into the economy and moving it closer to its historical growth average of 3.3 percent. However, more than 20 million people looking for a solid full-time job still can’t find one, and that has pushed down salaries for most Americans overall.

The full analysis of the polished diamond prices is available to IDEX Online Research subscribers and IDEX Online members here. Click here for more information on how to subscribe or become a member.