IDEX Online Research: US Specialty Jewelry Sales Down 3.9% in Oct

December 18, 14

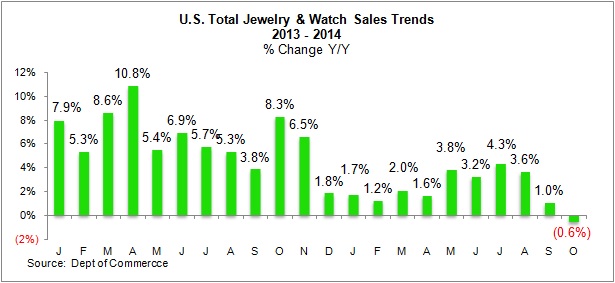

Jewelry demand in the U.S. market during October was extremely weak: down almost one percent from last year. Not only were monthly sales of fine jewelry and watches lower than last year, but prior months’ sales data were revised lower.

Fine jewelry sales fell by about one-half of one percent, while fine watch sales fell by 1.5 percent in October 2014 vs October 2013. Jewelry demand has been weak since mid-summer, and the current trend does not bode well for the all-important 2014 November-December Holiday Selling Season. Further, the modest jewelry sales gains in October lagged the robust total U.S. retail sales growth for all merchandise.

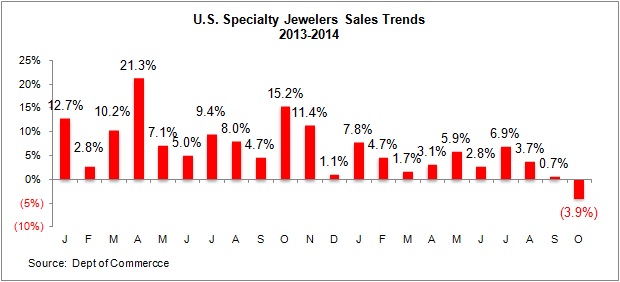

Specialty jewelers’ sales have been on a roller coaster this year, with solid gains in February (Valentine’s Day) and May (Mother’s Day). Since mid-summer, specialty jewelers have reported slowing sales, with a dramatic 3.9 percent decline in October, the first negative monthly comparison in 2014. Unless specialty jewelers’ sales show a strong pickup in November and December, they could give up market share to multi-line merchants like Wal-Mart, J.C. Penney, and Costco who also sell jewelry, continuing a trend that began in the late 1970s.

2014 Holiday Sales Outlook

Preliminary data for November from our sample of specialty jewelers show mixed results, with some merchants reporting solid gains while others have reported a dramatic sales decline. Our mall visits indicate that shopper traffic is good – but not great. Many mall stores are discounting heavily – 30 to 70 percent – across most or all of their merchandise lines, so jewelers’ typical “50 Percent Off” price promotions no longer resonate with shoppers.

The economic factors are positive: lower gasoline prices, a stronger job market, and a recovering economy are poised to help drive consumer spending. However, we have cut our jewelry sales forecast from our original four percent gain to a “low single-digit gain” for the 2014 Holiday selling season. As a result, 2014’s jewelry sales gain for November-December 2014 could be less than last year’s modest 2.9 percent gain.

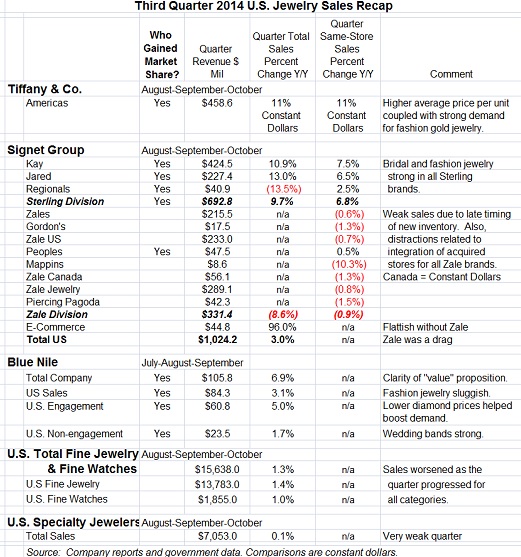

Q3 2014 U.S. Jewelry Sales Recap – Jewelry Demand Weak

While Tiffany, Sterling brands, and Blue Nile picked up market share, Zale brands lost market share in the third quarter of 2014. Overall, jewelry lost market share to other retail merchandise categories.

Total fine jewelry and fine watch sales rose 1.3 percent in the quarter, while specialty jewelers’ sales inched ahead by a meager 0.1 percent. Total U.S. retail sales (all merchandise categories) rose by 2.6 percent in the third quarter, while U.S. retail sales, ex-automobiles, were up by 3.0 percent. The table below summarizes third quarter jewelry industry sales trends.