IDEX Online Rough Diamond Market Report: No Direction

May 10, 12

|

Traders, manufacturers, brokers and other insiders were all reporting thinning margins and hardly any premiums at all on DTC boxes. This was not a warm welcome for the new Sightholders at the first Sight of the latest contract.

Changing Prices

As usual, the BHP Billiton auctions are the bellwether indicator (see prices below). As one insider pointed out, prices realized for the 2+ carat goods were broadly better than those of the smaller goods. Besides the difference in size, there was a difference in timing – the smaller goods were auctioned a week after the bigger goods.

As with polished, the (real) price of rough diamonds is gradually declining. The good news is that prices of rough and polished are still moving in unison.

Highlighting the accuracy of BHP's prices, trade in DTC boxes is very limited, and premiums, when the odd box is sold, are between 1-4 percent. In some cases, the price is below the DTC selling price, as table 1 below shows. According to an anecdotal report we received, as the Sight went on, premiums declined.

Prices at the DTC Sight last week did not change dramatically. Some were down a little (12 boxes), but the price of twice as many were up. It is true that there were some changes in box composition, affecting prices up and down, but the trend was clear – upwards.

While not an officially announced policy, conventional wisdom holds that De Beers CEO Philippe Mellier has a strategy of keeping prices high as long as applications are strong.

The problem is that this is not a "If they asked for it, let them have it," policy. It's more of a "If they asked for it, let them choke on it," situation and this is what the industry is trying to avoid. That is why prices in the open market are declining. Further proof, by the way, that this is a demand-driven market.

This time around, when all bar none are complaining that the DTC is expensive and manufacturers' margins are razor thin, it is indeed the case. At some point, DTC will need to either back down or improve assortments.

DTC's May Sight is estimated at $520-$550 million.

Alrosa is taking the same course as De Beers, holding prices as high as it can, much to manufacturers' silent dismay.

Demand Drivers

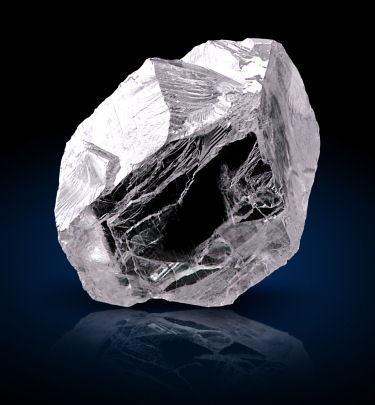

While sales of round cut diamonds are a struggle, princess cut and cushions are doing well. This is leading to improved demand for crystals, mainly 4 carats and smaller.

Other goods relatively sought after are pique goods and color.

Less favorable is a reported decline in demand for diamonds from the watch industry and

Outlook

While the long-term outlook is clear, the short and mid-term are shrouded in ambiguity. The rough sector seems to be without direction. Specific purchases are being made for specific business, while waiting for an improved market – whatever it is that may drive it. In the meantime, caution and margin protection is the name of the game.

| Demand for Key DTC Boxes following May Sight

Table 1 |

BHP Billiton April Spot Prices* Item March 2012 Price p/c April 2012 Price P/C % Change 2.5-6ct Z White HIGH $3,680.00 $3,731.00 1.4% 2.5-6ct Z White LOW $2,855.55 $2,806.00 (1.7%) 2.5-6ct MB White HIGH $3,411.00 $3,472.72 1.8% 2.5-6ct MB White LOW $2,727.00 $2,751.00 0.9% 2.5-6ct FA White $1,738.18 $1,616.00 (7.0%) 2.5-6ct CLV White $1,685.32 $1,674.00 (0.7%) 2.5-10ct ZMC CTD $1,381.18 $1,450.18 5.0% 2.5-10ct ZMC BRN $1,336.18 $1,342.86 0.5% 2.5-10ct CL/LO White $641.89 $627.27 (2.3%) 2.5-10ct CLV/LO BRN $235.00 $224.89 (4.3%) +2.5ct Rejections $122.40 $120.51 (1.5%) 4-8gr Z White HIGH $1,303.00 $1,244.00 (4.5%) 4-8gr Z White LOW $945.11 $875.00 (7.4%) 4-8gr MB White HIGH $1,072.00 $1,010.00 (5.8%) 4-8gr MB White LOW $861.00 $810.00 (5.9%) 4-8gr FA White $551.15 $557.00 1.1% 4-8gr CLV White $525.25 $486.16 (7.4%) 4-8gr ZMC BRN $354.00 $340.00 (4.0%) 4-8gr CL/LO White $228.81 $216.00 (5.6%) 4-8gr CL/LO Brown $90.49 Unsold - +9-3gr Z White $321.75 $315.00 (2.1%) +9-3gr MB White $272.18 $250.01 (8.1%) +9-3gr CLV White $162.72 $156.51 (3.8%) +9-3gr ZMC BRN $58.58 $52.25 (10.8%) +9-8gr ZMC CTD $215.00 $198.00 (7.9%) +9-8gr Rejections $43.11 $36.23 (16.0%) -9 ROM $111.11 $100.77 (9.3%)

*All BHP Billiton price data collected from third parties