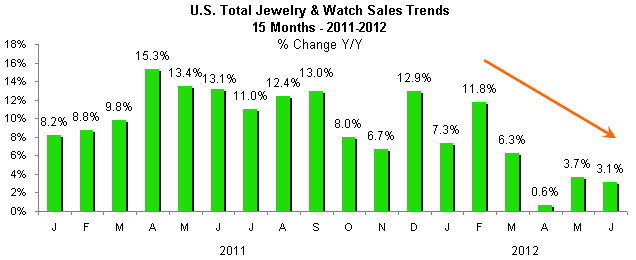

IDEX Online Research: U.S. Jewelry Sales Gains Slowing in First Half; Outlook Guarded

September 09, 12

(IDEX Online News) – Uncertain American consumers have kept a tight rein on their jewelry spending in 2012. Total jewelry sales rose by just over 5 percent for the first six months of 2012, far below last year’s torrid pace of an 11 percent gain. Further, monthly jewelry demand in the

Source: US Dept of Commercce |

Shoppers’ uncertainty – and the resulting spending restraint – won’t be resolved quickly. The major consumer uncertainties include the outcome of the presidential election in November, the faltering

2012 Jewelry Sales Muted

Consumer demand trends for jewelry in the American market are as follows:

· Retail demand in the first half of 2012 has been more muted than expected, for both jewelry and all retail merchandise. Consumers have kept their purse strings tight.

· Fine jewelry and watch sales gains of 5.3 percent were about in line with total retail sales (ex-automobiles) gain of about 5.4 percent for the first six months of 2012.

· Demand for fine jewelry outpaced demand for fine watches. Some of this is related to price inflation of components used in jewelry. For the first half of 2012, jewelry sales are up by 5.5 percent, while fine watch sales are up by 4.5 percent.

· Specialty jewelers lost market share to multi-line merchants who sell jewelry during the first six months of 2012. Multi-line jewelers, such as Wal-Mart, Costco and J.C. Penney have been promoting broad merchandise categories – apparel, seasonal hardlines and other goods – that could provide a major boost to customer traffic and jewelry sales have benefitted. Specialty jewelers’ sales account for only about 43 percent of total

· High-end jewelry and watches showed stronger demand than popular-priced merchandise.

Outlook: Moderate Gains

While we have not officially changed our full-year jewelry sales forecast – in the range of a 4 percent gain for the

Jewelry sales in the