IDEX Online Research: U.S. Retail Jewelry Prices Rise in August

September 27, 12

(IDEX Online News) – Retail prices of jewelry have been bouncing like a basketball this year. August was no exception: retail prices of jewelry jumped sharply in August, after very weak trends beginning in March, according to the latest data from the U.S. Bureau of Labor Statistics. However, despite the rise in retail jewelry prices in August, they are still below their peak in October 2011.

The full analysis and statistics on jewelry industry inflation for August 2012 is available to IDEX Online Research subscribers and IDEX Online members here.

In contrast, suppliers’ jewelry prices remained relatively stable in August, and have shown very little fluctuation in 2012. Inflation pressures for finished jewelry at the wholesale level have abated due to the lack of price inflation of major components of jewelry including polished diamonds, gold, platinum and silver.

Why is this dichotomy occurring? In the face of weak demand for jewelry, retail merchants are testing the market to see if they can raise prices – in an effort to recapture lost margin over the past few years as commodity prices have risen – without hurting consumer demand for gemstones and precious metal merchandise.

The Big Picture: No Jewelry Price Inflation in 2012

Despite some month-to-month price changes – with significant volatility of retail jewelry prices – neither wholesale jewelry prices nor retail jewelry prices have shown any significant inflation – or deflation – since the beginning of the year. Wholesale jewelry prices have been relatively stable, while retail jewelry prices have bounced around substantially on a month-to-month basis, but they have made no headway upward this year. In fact, they peaked in October 2011, and have lost ground since then.

Earlier this year, retail jewelers were hesitant to raise their retail prices, since jewelry demand was relatively weak. Though retail jewelry sales remain relatively weak, jewelers have decided to move ahead with price increases. They are betting that jewelry demand will not be affected significantly; further, they need to move prices higher prior to the holiday selling season. In some cases, they have raised prices so they can discount them during the holiday selling season, without breaking any commerce laws (which say that an item must have been offered for a minimum period at the higher price, if the discount is legitimate).

However, it is important to note that the consumer environment of high levels of uncertainty is unchanged. The current climate of uncertainty is being driven by the upcoming presidential election, a faltering economy, the lack of job security, and a weak housing market. When consumers are uncertain, they tighten their purse strings.

WHOLESALE: Jewelry Prices Stable in August

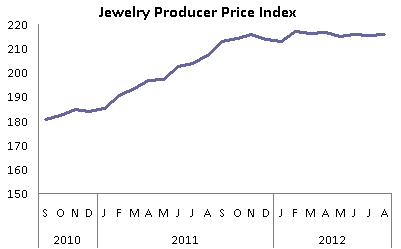

In August, the Jewelry Producer Price Index (JPPI) stood at 216.0, up from July’s 215.5. A year ago, the JPPI stood at 207.2. Since February, the index has stabilized in the 216-217 range. Here’s what this data means:

· Wholesale jewelry prices rose modestly by 0.2 percent on a month-to-month comparison basis: August versus July 2012. As the graph below illustrates, there has been little jewelry price inflation on a monthly basis since the beginning of 2012; prices have been relatively stable.

· Wholesale jewelry prices rose by about 4.2 percent on a year-to-year comparison basis: August 2012 versus August 2011. This inflation rate is down substantially from the double-digit inflation rates in the first quarter of 2012, and it is only the fourth single-digit inflation rate in almost two years.

· Wholesale jewelry prices have basically remained unchanged this year, so far.

· Wholesale jewelry prices were up 9.5 percent for the eight months year-to-date 2012 versus the same period a year ago.

Source: BLS |

RETAIL: Jewelry Prices Rise Sharply in August

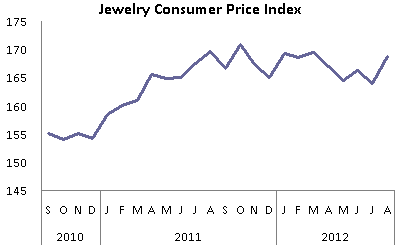

In August, the Jewelry Consumer Price Index (JCPI) stood at 168.7 versus July’s 164.0. A year ago, the JCPI stood at 169.6. Since the beginning of the year, the retail jewelry price index has remained in the 167-168 range, though it has shown some volatility, dipping to 164 in May and July. Here’s what this means:

· Retail prices of jewelry rose by 2.9 percent on a month-to-month comparison basis: August versus July 2012. This implies an annual inflation rate of nearly 36 percent, an unsustainable level.

· Retail jewelry prices in August were 0.5 percent below prices in August 2011. Retail prices of jewelry have shown no significant inflation since mid-2011.

· Despite the sharp month-to-month increase in August, retail jewelry prices are still slightly below levels of January 2012. In short, retailers have not yet made up for the deflationary price trends, which occurred between January and July 2012. Retail jewelers’ margins remain squeezed.

· Retail jewelry prices were up by a modest 2.0 percent for the eight months year-to-date 2012 versus the same period a year ago.

· The graph below summarizes the JCPI over the past two years:

Source: BLS |

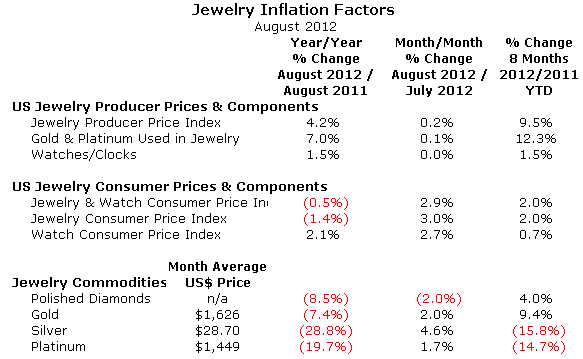

In general, prices of jewelry commodities – precious metals and diamonds – as well as retail jewelry prices are lower this year than last year at the same time. Even wholesale price inflation increases have moderated. For the eight-months so far in 2012, jewelry prices in the

The table below provides detailed inflation / deflation rates for jewelry components as well as inflation rates at various levels of the jewelry distribution channel in the

Source: Various Markets |

Jewelry Inflation Outlook Unchanged: Moderating Inflation in 2012

Our outlook for jewelry price inflation remains unchanged: jewelry prices are expected to move modestly higher at all levels of the distribution channel throughout 2012. However, the rate of inflation is expected to be well below 2011’s torrid pace, both at the supplier level and at the retail level.

It would be easy to forecast inflation for the jewelry industry if all of the commodities involved in the forecast were used exclusively by the jewelry industry. While that may be the case for polished diamonds, precious metals are used by a number of other industries. Further, gold is an international currency that plays in a financial arena of its own.

· Jewelry Industry Long Term Outlook – Demand from emerging economies such as

· Global Economic Outlook for 2012-2013 – The latest OECD data continues to point to moderate economic growth with a “cautious” outlook in the next 12-18 months. This is a revision from a more positive outlook earlier this year.

· Gold Market Outlook for 2012-2013 – With continued volatility in the world’s stock markets and uncertain valuations related to stocks, bonds and other hard assets, investors may seek the safe haven that gold offers. Despite predictions by others that gold will hit $2,000 this year, we are not ready to embrace those forecasts. However, within the past few weeks, several forecasters have predicted that gold will surge through the $2,000 mark sometime early in 2013. Markets tend to discount the “herd” mentality.

The bottom line: inflation is headed higher over the longer term, but at a more moderate rate. Jewelry suppliers and retailers should use periods of weakness in commodity prices to add to their inventory.

The full analysis and statistics on jewelry industry inflation for August 2012 is available to IDEX Online Research subscribers and IDEX Online members here. Click here for more information on how to subscribe or become a member.