IDEX Online Research: Wholesale Jewelry Prices Rise, But Retail Prices Fall in February

March 27, 13

(IDEX Online News) – Suppliers’ wholesale prices of jewelry rose in February, but retail jewelry merchants had to slash prices in order to attract Valentine’s shoppers when compared to year-ago data provided by the Bureau of Labor Statistics, the official government agency charged with supplying price inflation data in the U.S. market.

The full analysis and statistics on jewelry industry inflation for February 2013 is available to IDEX Online Research subscribers and IDEX Online members here and here.

Here are the key inflation trends for the

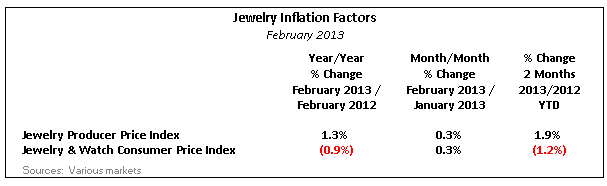

· Jewelry suppliers’ wholesale prices were up by 0.3 percent, when comparing February 2013 prices to January 2013 prices.

· Jewelry suppliers’ wholesale prices were up by 1.3 percent, when comparing February 2013 prices to the same month a year ago.

· Jewelry retail prices rose by a very modest 0.3 percent, when comparing February 2013 prices to January 2013 prices.

· Jewelry retail prices were down 0.9 percent, when comparing February 2013 prices to February 2012. This means that retail jewelry prices in the

The table below summarizes key inflation / deflation data for the

Long Term: Retail Margin Squeeze Increased in February

Normally, jewelry suppliers’ prices correlate closely with prices of underlying “jewelry” commodities including precious metals and polished diamonds. That did not happen in February: except for platinum, gold, diamond and silver prices were lower in February 2013 than in February 2012. More likely, the February supplier price increases are related to wage increases that are often given near the beginning of the calendar year. In the past, a strong U.S. dollar has helped offset jewelry suppliers’ labor cost increases.

Retail jewelry prices have been both volatile and erratic. Retail merchants of jewelry tried to raise prices several times recently to boost their margins, but have been forced to roll back most those price hikes due to weaker-than-expected demand.

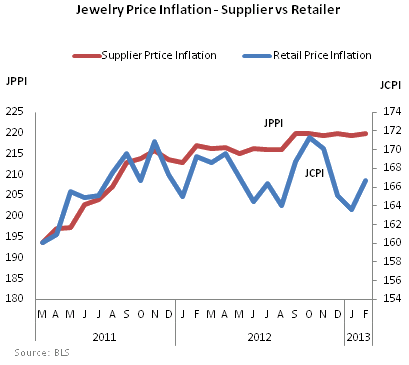

When jewelry suppliers’ prices are compared to retail jewelry prices, it is clear that retailers’ long-term margin squeeze increased in 2012 and in the first two months of 2013.

The graph below summarizes twenty-four months of inflation and deflation for the

Detailed Inflation and Deflation Data

The full analysis and statistics on jewelry industry inflation for February 2013 is available to IDEX Online Research subscribers and IDEX Online members here (supplier) and here (retail). Click here for more information on how to subscribe or become a member.