IDEX Online Research: U.S. Jewelry Sales Keep Slowing

September 24, 12

(IDEX Online News) – Specialty jewelers in the

The full analysis and statistics on jewelry industry inflation for July 2012 is available to IDEX Online Research subscribers and IDEX Online members here.

Total jewelry sales rose by just under 4 percent in July, somewhat below June’s revised 4 percent gain. These monthly gains were far below last year’s near record growth of 11 percent for the twelve months of 2011, and they illustrate the slowing pace of jewelry industry sales in the American market. Jewelry demand in the

Uncertain American consumers have continued to keep a tight rein on their jewelry spending this year. Unfortunately, shoppers’ uncertainty – and the resulting spending restraint – is not likely to change any time soon. The uncertainties, which won’t be resolved quickly, include the outcome of the presidential election in November, the faltering

There is only one reasonably bright spot: we have not changed our jewelry sales forecast for the full year of 2012 – in the range of a 4 percent gain for the

HIGHLIGHTS: July Jewelry Sales Muted

Consumer demand trends for jewelry in the American market are as follows:

· Fine jewelry and watch sales were stronger than total retail sales (excluding automobiles) as well as total retail sales gains including the highly volatile automobile category.

· Demand for fine jewelry outpaced demand for fine watches. Some of this is related to price inflation of components used in jewelry.

· Specialty jewelers lost market share to multi-line merchants who sell jewelry. July is often a slow month for specialty jewelers, with mall traffic down due to summer vacations.

DEMAND For Jewelry: Sales Slowing

Jewelry sales in the

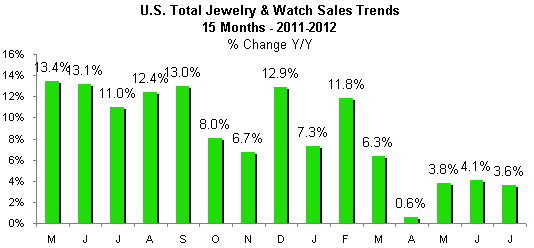

The graph below summarizes total jewelry sales gains by month for the past 15 months.

Source: US Dept of Commerce |

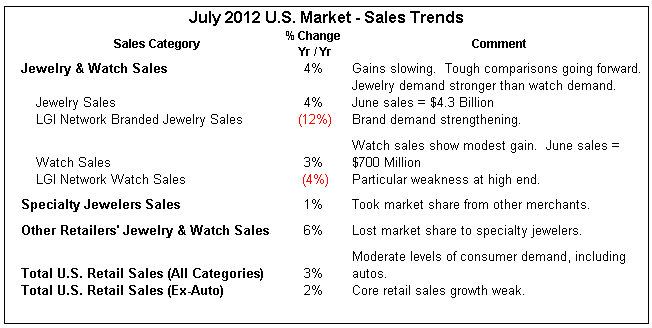

Source: US Dept of Commerce & LGI Group |

Outlook: Moderate Gains

Jewelry sales in the

We continue to forecast that sales of fine jewelry and watches will rise by about 4 percent in 2012, when compared to 2011. While the percentage gain is modest, 2012 will be a record year for the American jewelry industry.

A reminder:

The full analysis and statistics on jewelry industry inflation for July 2012 is available to IDEX Online Research subscribers and IDEX Online members